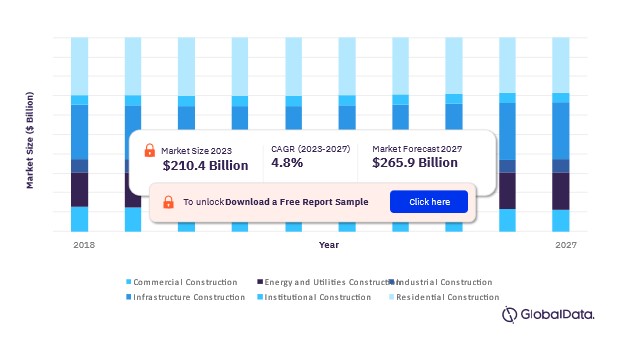

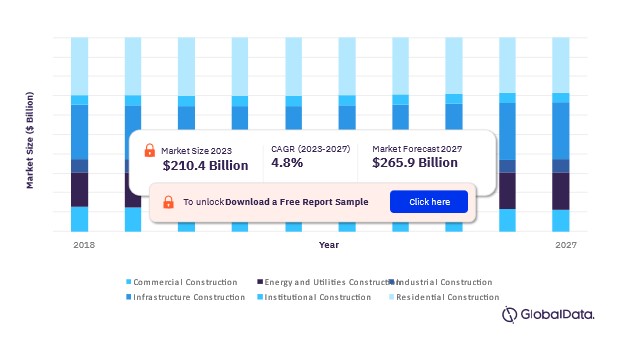

Sub-Saharan Africa Construction market size is expected to reach $265.9 billion by 2027, according to a new report by GlobalData Plc. The rising inclination towards setting energy and transport infrastructure in the region is expected to drive market growth over the forecast period.

Sub-Saharan Africa Construction Market Share by Sectors, 2018 – 2027 (%)

Sub-Saharan Africa construction market outlook report is available at GlobalData Now! Read our Free Sample Report

Sub-Saharan Africa Construction Market FAQs

- What was the Sub-Saharan Africa construction market size in 2023?

The Sub-Saharan Africa construction market size is estimated to be $210.4 billion in 2023.

- What is the Sub-Saharan Africa construction market growth rate?

The construction market in the Sub-Saharan Africa region is expected to grow at a CAGR of 4.8% during 2023-2027.

- What are the key sectors in the Sub-Saharan African construction market?

The key sectors in the Sub-Saharan Africa construction market are commercial construction, energy and utilities construction, industrial construction, infrastructure construction, institutional construction, and residential construction.

- Which are the key countries in the Sub-Saharan Africa construction market?

The key countries in the Sub-Saharan Africa construction market are Angola, Cameroon, Ethiopia, Ghana, Kenya, Mozambique, Nigeria, South Africa, Tanzania, and Zambia.

Want to Get Answers to Any Further Queries? Download Free Sample Report

Sub-Saharan Africa Construction Market Dynamics

Sub-Saharan Africa’s construction industry is predicted to grow by 2.5% in the current year, aided by the uptick in the regional infrastructure sector. In the medium to long term, the region presents an attractive proposition for growth owing to the vastly underdeveloped infrastructure, the rising population growth as well as the growing urbanization in the region.

Learn about the Sub-Saharan Africa Construction Market Dynamics by Viewing the Report Sample Right Here!

Sub-Saharan Africa Construction Report Highlights

- The Sub-Saharan Africa Construction market is predicted to grow at a compound annual growth rate of 4.8% over the forecast period. Investments in the commercial sector are expected to benefit in the medium to long term owing to pent-up demand for retail, offices, and leisure and hospitality segment.

- Residential construction was the largest sector in the Sub-Saharan African construction industry in 2022, accounting for 30.1% of the region’s total value that year. The sector is estimated to grow by 1.3% this year, before recording annual growth in the range of 4.7% from 2024 to 2027.

- The infrastructure construction category is estimated to account for the second largest regional share in real terms in 2023, supported by investments in the regional’s transport infrastructure projects, coupled with the construction of cross-border infrastructure projects.

- The construction sector of Ethiopia is expected to account for the largest regional share in real terms in 2023. The industry’s growth in 2023 will be supported by rising FDI, coupled with the re-start of halted development projects, following an easing of the armed conflict.

- The Nigerian construction sector is anticipated to register second place in the regional mix in real terms in 2023. The domestic construction sector is predicted to grow marginally by 0.9% owing to the impact of elevated costs for materials, energy, and labor, and the continued tightening of monetary policy along with the ongoing cash crunch.

Unlock additional market dynamics impacting the Sub-Saharan Africa Construction market growth by Requesting a Sample PDF

Sub-Saharan Africa Construction Market Scope

GlobalData Plc has segmented the Sub-Saharan Africa construction market report by sectors and countries:

Sub-Saharan Africa Construction Sectors Outlook (Value, $ Million, 2018-2027)

- Commercial Construction

- Energy and Utilities Construction

- Industrial Construction

- Infrastructure Construction

- Institutional Construction

- Residential Construction

Sub-Saharan Africa Construction Countries Outlook (Value, $ Million, 2018-2027)

- Angola

- Cameroon

- Ethiopia

- Ghana

- Kenya

- Mozambique

- Nigeria

- South Africa

- Tanzania

- Zambia

Request for a free sample for more segment-wise insights and outlook

Related Reports

- Construction Market Size, Trends and Growth Forecasts by Key Regions and Countries, 2023-2027 – Click here

- Ethiopia Construction Market Size, Trend Analysis by Sector (Commercial, Industrial, Infrastructure, Energy and Utilities, Institutional and Residential) and Forecast, 2023-2027 – Click here

- Nigeria Construction Market Size, Trend Analysis by Sector (Commercial, Industrial, Infrastructure, Energy and Utilities, Institutional and Residential) and Forecast, 2023-2027 – Click here

- South Africa Construction Market Size, Trend Analysis by Sector (Commercial, Industrial, Infrastructure, Energy and Utilities, Institutional and Residential) and Forecast, 2023-2027 – Click here

- Colombia Construction Market Size, Trend Analysis by Sector (Commercial, Industrial, Infrastructure, Energy and Utilities, Institutional and Residential) and Forecast, 2023-2027 – Click here

- Angola Construction Market Size, Trend Analysis by Sector (Commercial, Industrial, Infrastructure, Energy and Utilities, Institutional and Residential) and Forecast, 2023-2027 – Click here

- Kenya Construction Market Size, Trend Analysis by Sector (Commercial, Industrial, Infrastructure, Energy and Utilities, Institutional and Residential) and Forecast, 2023-2027 – Click here

About us

GlobalData is a leading provider of data, analytics, and insights on the world’s largest industries. In an increasingly fast-moving, complex, and uncertain world, it has never been harder for organizations and decision-makers to predict and navigate the future. GlobalData’s mission is to help our clients to decode the future and profit from faster, more informed decisions. As a leading information services company, thousands of clients rely on us for trusted, timely, and actionable intelligence. Our solutions are designed to provide a daily edge to professionals within corporations, financial institutions, professional services, and government agencies.