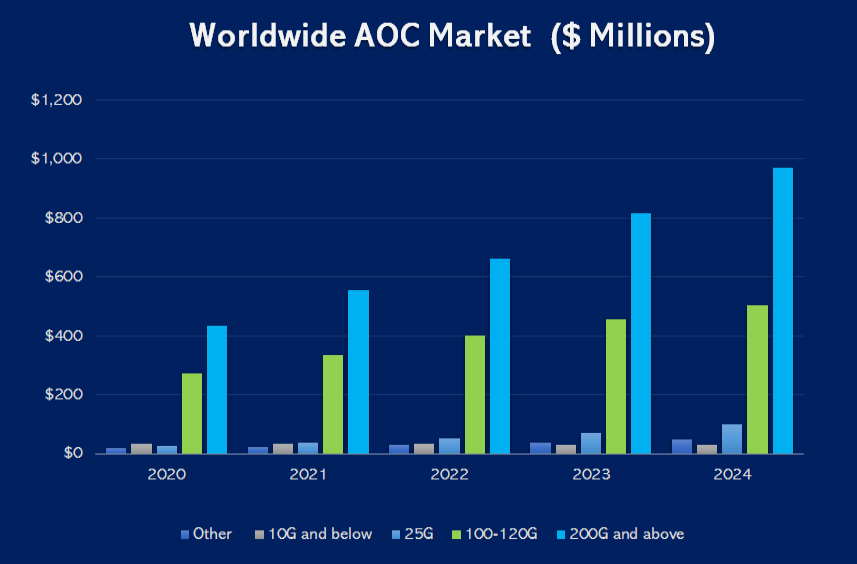

Crozet, Virginia: Communications Industry Researchers (CIR), has just issued a new report stating that revenues from active optical cables (AOCs) will reach $1.9 billion by 2024 compared to $954 million in 2020. This doubling in market size will be due to the rush to deploy 100G links in data centers and the likelihood that 2020 will be the year that data centers start to fill the 400G ports on their new switches.

Compared to connectorized cables, AOCs present a way to dramatically minimize the cost of optics while making installing transceivers and cabling considerably more user friendly and easy to test. CIR has been covering the market for AOCs longer than any other established industry analysis firm and has issued analysis and market forecasts of AOCs dating back well over ten years. According to Lawrence Gasman, author of this new study and President of CIR, the forecasts represent a downward revision of CIR’s 2018 AOC projections. “There has been considerable price pressure on AOCs in the past couple of years,” says Gasman, “At the same time, DACs have proved strongly competitive with AOCs in the data center, while video/consumer AOCs have shown no signs of growing beyond niche markets such as professional video and video extenders in bars.

Details about the report are available at https://cir-inc.com/reports/active-optical-cables-market-forecasts-2020-to-2024/

About the report:

This report provides a new assessment of the market opportunities for Active Optical Cables. Not only does the report examine the role of AOCs in a world of hyper-scale data centers and 400G transmission, but it also examines whether video/consumer AOCs can expand beyond niche markets such as video extenders for bars and restaurants. This is the only analyst report that looks at the market for AOCs in specialized environments such as the military, telecommunications, and supercomputing.

The report discusses AOC applications in data centers and the computer industry (Ethernet, InfiniBand, PCIe, and storage networks), along with digital signage; professional video, etc. (USB, HDMI, DisplayPort, and Thunderbolt). It also profiles leading branded AOC products including AOCs from 10Gtek, Hisense, InnoLight, Mellanox, Cisco, Intel, II-VI (Finisar), Amphenol, Fujitsu, Broadcom, Cosemi, Melanox, Cisco, Intel, Molex, Samtec and Siemon.

The report also provides coverage of the role of OEMs, retailers, distributors, and third-party (compatible) suppliers in the AOC supply chain. And, CIR has included an analysis of factors influencing AOC supply chains around the globe including in North America, Europe, Japan, and China.

The textual analysis in this report is shipped with a spreadsheet containing CIR’s five-year forecasts in volume and value terms. These forecasts include breakouts by cable length, data rate, MSA, type of fiber, etc. for data centers, computer industry applications, and video/consumer applications.

From the report:

For many years, the AOC market has been dominated by Chinese manufacturers. Current geopolitical/COVID-19 related events seem certain to disrupt this situation. AOC firms will begin reshoring AOC manufacturing in 2021 and will also move manufacturing to low labor cost nations such as India and Vietnam. The Chinese domestic market is likely to be increasingly a captive of local Chinese AOC makers. Chinese data centers are strongly encouraged by government policy to buy from Chinese AOC suppliers. By 2024, revenues from AOC sales in China will reach approximately $380 million.

By far the largest segment of the AOC market will be the 200G and above segment, which is expected to reach $970 million by 2024. However, if a technology breakthrough occurs that significantly reduces the cost of 200G/400G transceivers, this $970 million number may be reduced significantly. Also, AOCs are a child of the pluggable optics revolution, but if the market moves towards on-board optics and co-packaged optics, AOCs may have reached the end of the road.

While revenues from AOCs will be impacted to some extent by the recessionary impact of COVID-19, work-from-home policies are leading to a COVID-19 related boom in bandwidth demand. This has led to a “surge” for components for network spares and to rapidly expand networks. AOCs are especially relevant here – they are a quick fix for interconnects that need to be upgraded with fiber.

About CIR:

Communications Industry Researchers (CIR) (www.cir-inc.com) has published a hype-free industry analysis for the optical networking industry for nearly 30 years. Our reports on short-reach optical communications contain the most authoritative market forecast and technology assessment available.