The 2024 Super Bowl generated an ironic achievement. It was blessed with an estimated record number of 120.3 million TV viewers on CBS alone, according to Nielsen.

However, a seven-year longitudinal study by Bottom-Line Analytics (BLA), an advanced analytics and market mix modeling firm, shows that this year’s Super Bowl ads were the weakest in a decade. It’s time to ensure that Super Bowl advertising delivers!

ABX Advertising Benchmark Index™ has provided to BLA advertising effectiveness scores for all Super Bowl ads for the past eleven years. The ABX Index™, a composite score of the most critical of 14 KPIs, is based on its 425,000 tested ads globally. The study toplines revealed that Super Bowl 2024 ads were:

The 2024 Super Bowl audience was more diverse than in past events, with more Gen Z (age 18-24) and female viewers. Findings suggest that the record number of under-performing ads was due to a failure to speak clearly to, and engage, this broader audience.

The Effectiveness of TV Commercials during the 2024 Super Bowl

This is the seventh consecutive year that Michael Wolfe, CEO of Bottom-Line Analytics, has written this evaluation. The purpose has been to derive a fact-based assessment of the value of Super Bowl advertising.

Ad Effectiveness Data Provider

It makes sense that evaluating ad effectiveness starts with a large and reliable source of advertising creative copy tests. As mentioned above, ABX Advertising Benchmark Index has been our key source of ad effectiveness measurement due to its exceptionally large and historical global database. For the 2024 Super Bowl, we evaluated 63 brands’ in-game TV spots.

The Big Picture View of the 2024 Super Bowl

As above, the 2024 Super Bowl achieved a milestone by delivering more than 120.3 million TV viewers. Super Bowl continues to be the most-watched program ever, which is key to attracting advertisers.

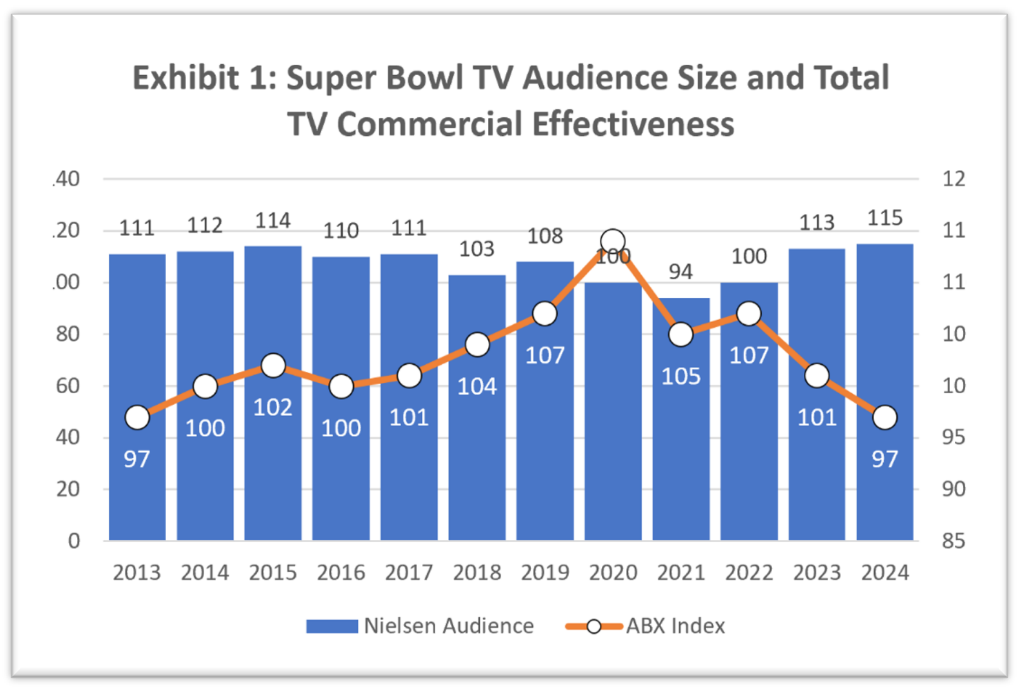

While more eyeballs are a good thing, the decline in ad effectiveness scores is not. As seen in Exhibit 1, the trend in Super Bowl ad effectiveness since 2020 has been declining.

This is the worst performance in 10 years and is clearly the number one issue going forward.

The Cost of Super-Bowl Advertising

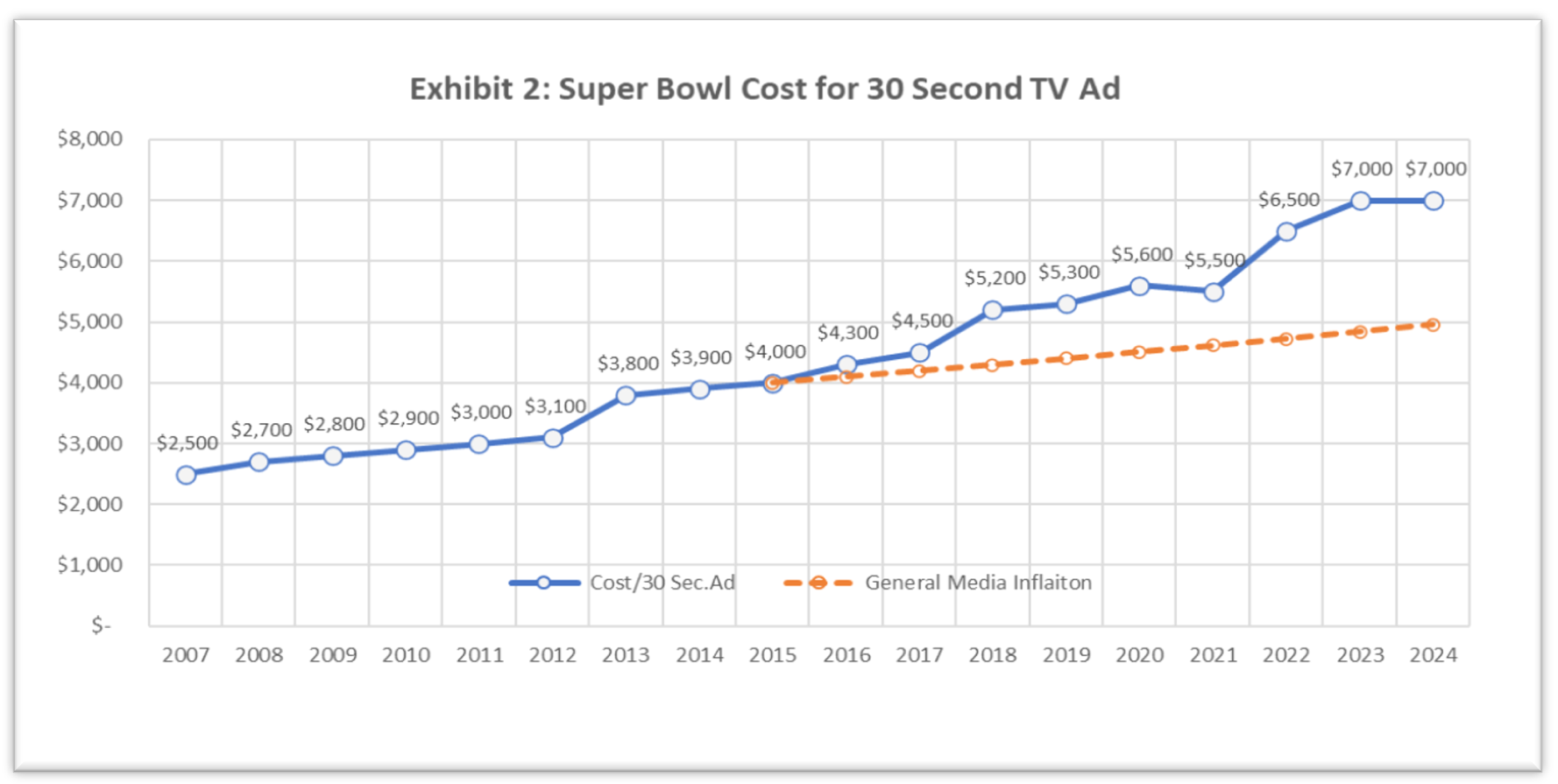

The networks selling Super Bowl advertising do better than striking gold. For the second consecutive year, the average cost for a 30-second Super Bowl spot was reported at $7 million, about 35 times more than the normal national 30-second ad.

Exhibit 2 shows the progression of Super-Bowl ad costs over time. Since 2014, average ad costs for the Super-Bowl have grown 5.8% per year, which is more than two times faster than the national media increase of 2.4% annually.1

2024 Super-Bowl Ad Performance: Where the Rubber hits the Road.

Given the above, one must ask: is there really a positive ROI from Super-Bowl advertising?

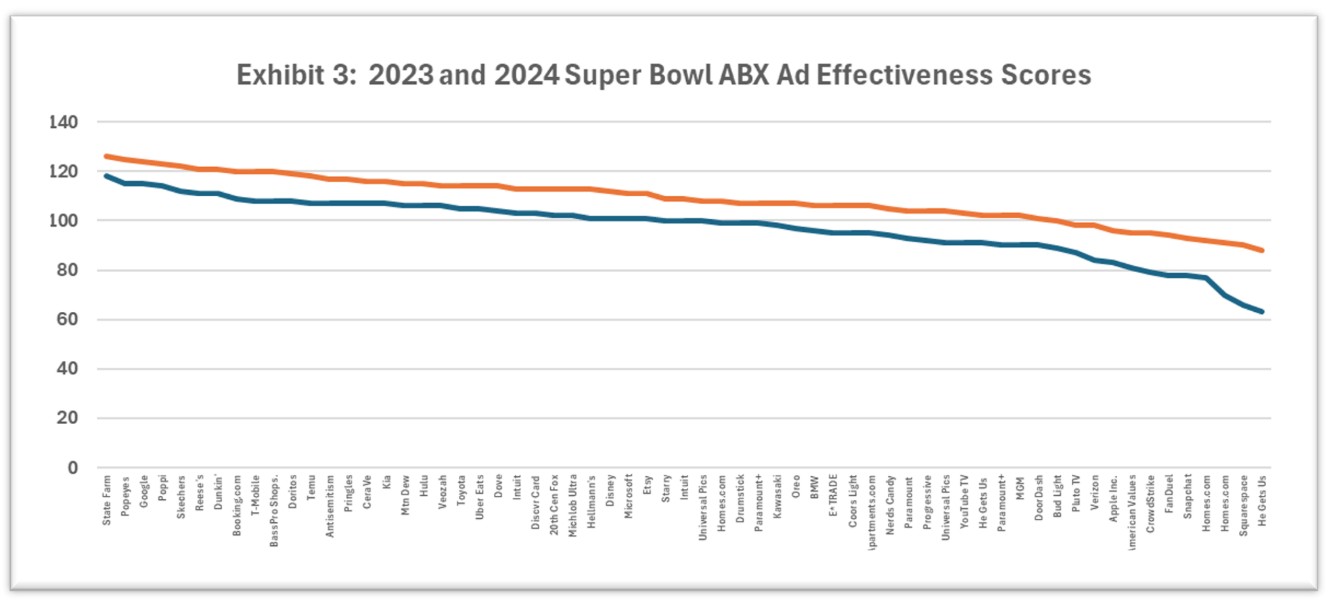

Exhibit 3 shows an overlay of the 2023 and 2024 individual scores of each ad aired.

The ROI of 2024 Super Bowl Ads

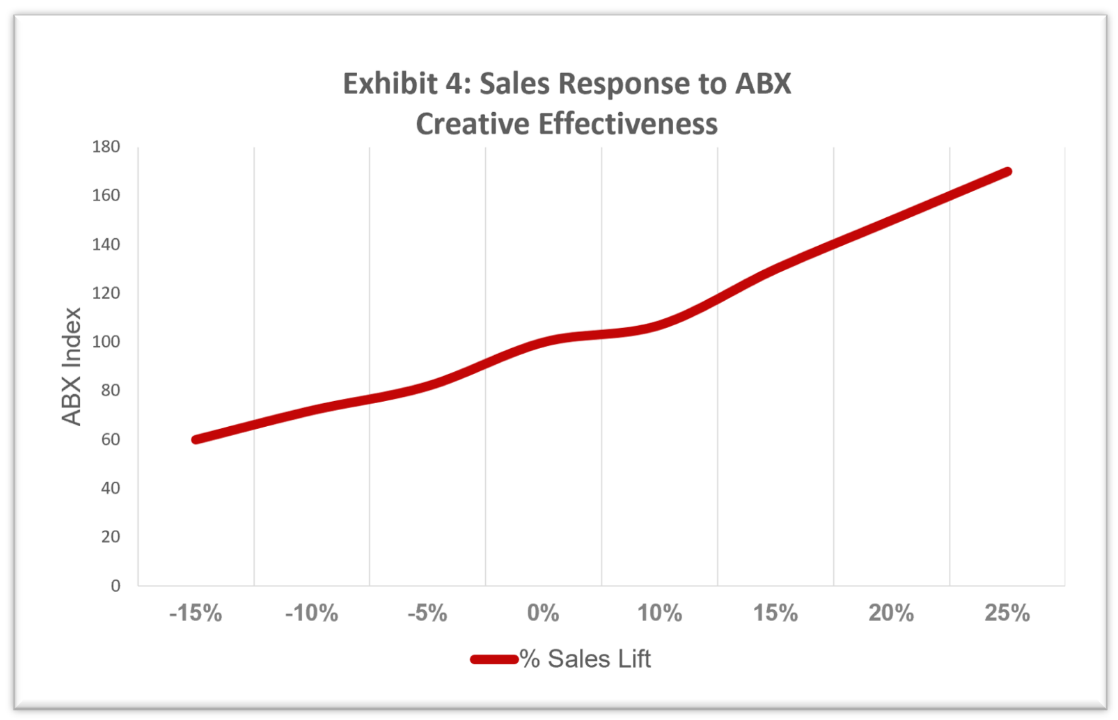

If there is positive ROI in Super Bowl advertising, we need to link ABX Index scores to sales. Bottom-Line Analytics has done this and the sales response to ad creative scores is summarized in Exhibit 4.

By linking Super-Bowl advertising effectiveness scores to this sales response curve, we can estimate sales-lifts and, in turn, derive the individual returns-per-dollar for brands with published retail sales. Exhibit 4 is thus a model for determining ROIs of individual Super-Bowl ads.

Super Bowl 2024 Returns for 15 Brands

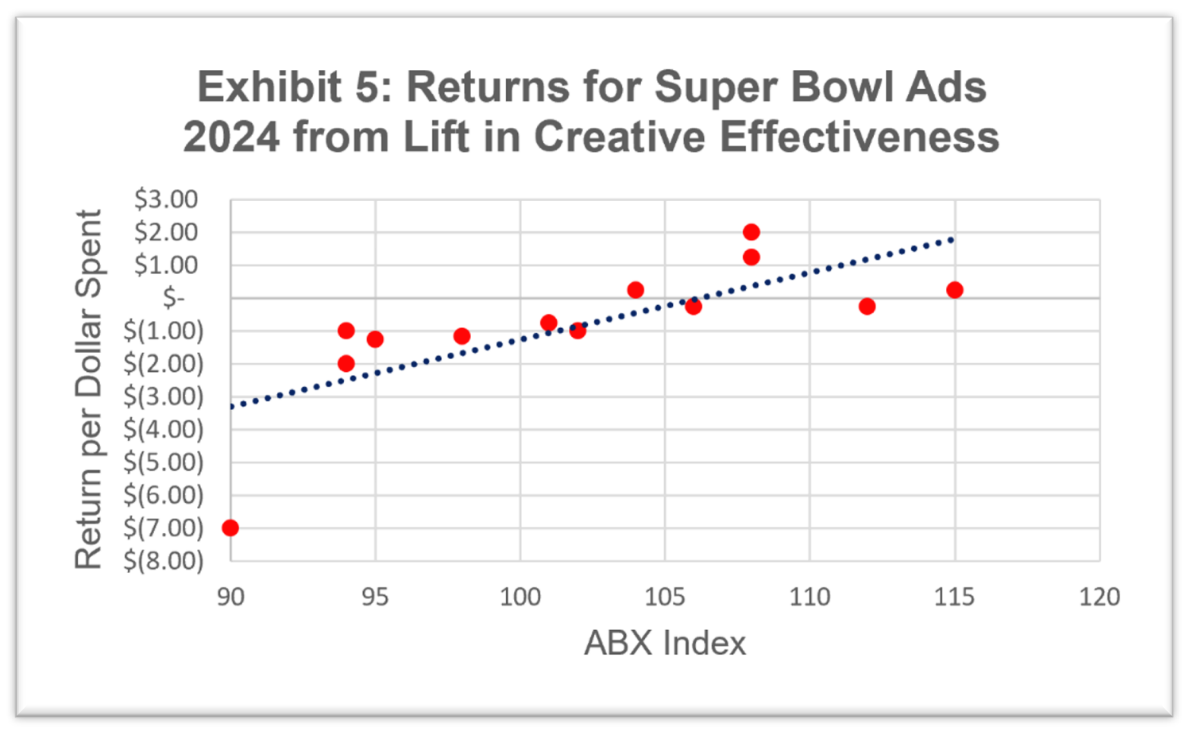

Below on Exhibit 5, we plotted returns for fifteen of the featured ads. The brands selected were mostly food, beverage or retailer brands whose retail sales were readily available. The key metric used was the two-week average of sales derived from annual brand sales. (Using two-week instead of one-week sales revenues tips the results towards more ads in favor of positive profit).

The results shown below reflect the positive or negative profit-per-dollar cost from the calculated sales lift. As the results show, 4 of the 15 ads were profitable, while the remaining 11 were not. The profitable ads tended to be from brands with higher sales revenue and higher ABX Index creative scores. While this is not conclusive proof, we think that short-term positive ROI is uncommon for Super Bowl advertising.

Comparing Super Bowl Ad Effectiveness with Other Sports Properties

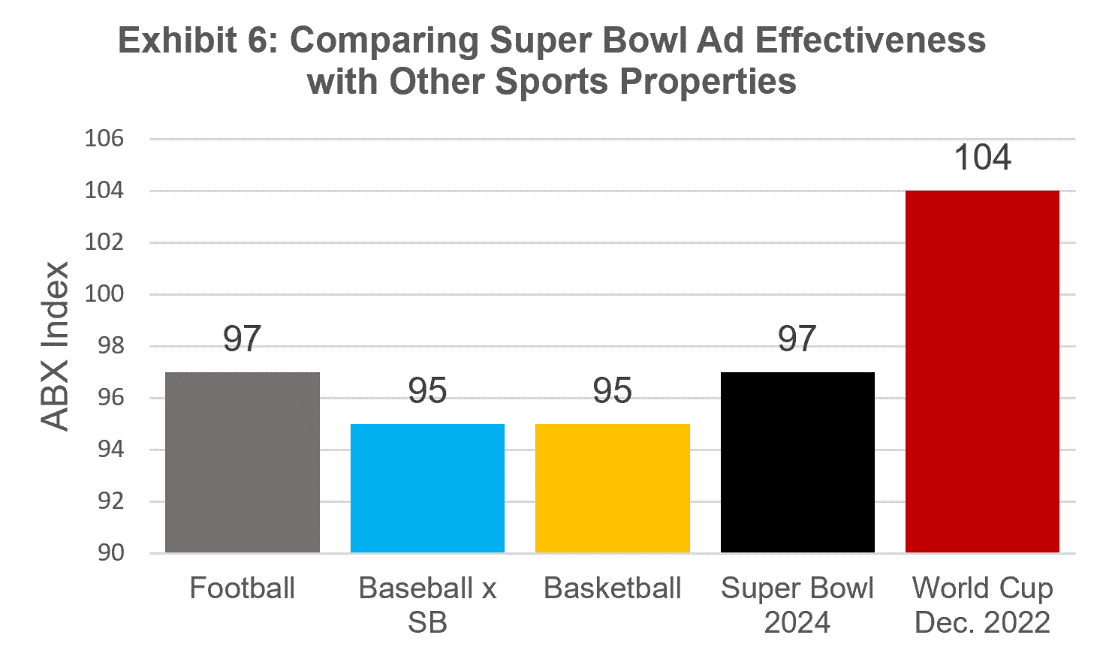

Exhibit 6 addresses the question of whether Super Bowl ads stand out relative to brand advertising in other sports properties. Here we compare 2024 Super Bowl ad effectiveness scores with those of other sports properties, and with other football-linked ads.

Football property ads slightly outperform Basketball & Baseball advertising. But Super Bowl ads are no better than other football-sponsored ads and fall significantly below the most recent World Cup advertising.

Are Super Bowl Ads More Effective than Brand Ads Throughout the Year?

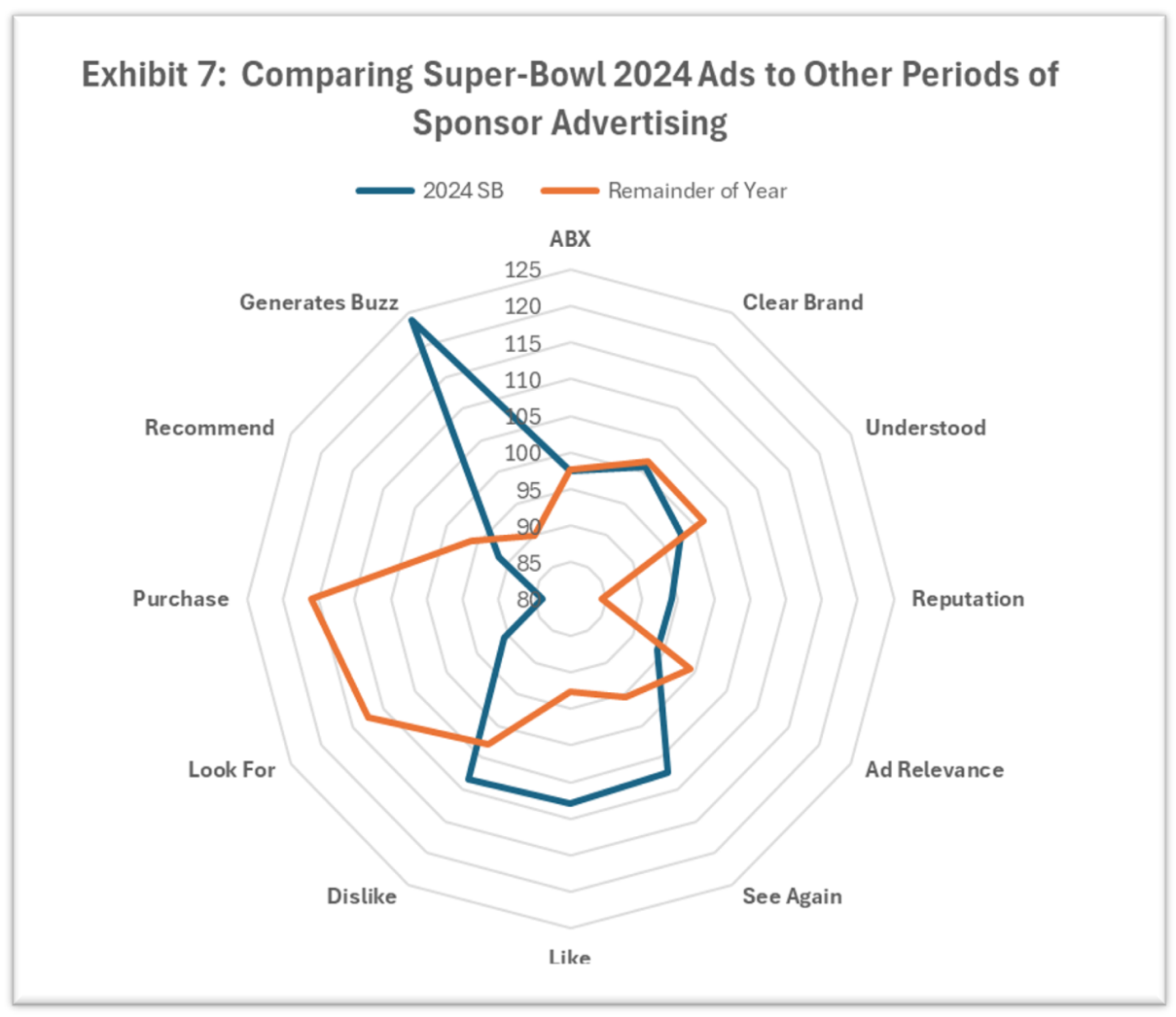

In last year’s report, there was a large gap showing Super Bowl ads underperforming against sponsor ads during the rest of the year. The good news is that the 2024 Super Bowl ads were at parity with ads during other parts of the year.

Super Bowl ads’ advantages included Liked more, Reputation higher, and Word-of-Mouth as the highest KPI of all.

By contrast, the ads were also Disliked more, less Relevant and didn’t motivate consumers to respond with “Any Action,” (which is comprised of Contact the Company, Visit the Website, Look for More Information, Intent to Purchase, Recommend or Talk to Someone). A brand with declining sales is not likely to experience a solid turnaround by running a Super Bowl ad.

For an analysis of the Top and Bottom Five Ads ranked by “Any Action,” see the recent ABX news release, “Seventy-Two Percent of Super Bowl Ads Miss the Mark.”

The Demographics of Super Bowl Advertising

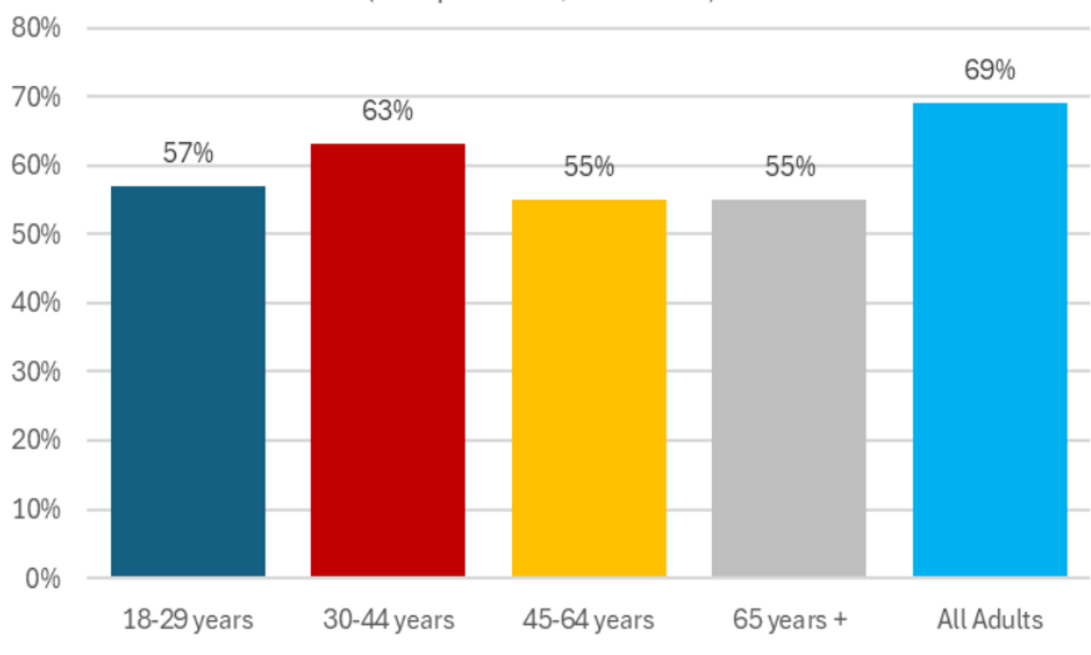

On Exhibit 8, we see creative scores across age, income, gender, and ethnic groups. The results show that Gen Z, (18–24-year-olds), posted the highest overall rating, while the older group (50+), which tends to show the lowest average scores, had the largest year-over-year increase in ad ratings. In terms of genders, white males still show the highest scores, but females showed a solid increase from last year.

Even though Super Bowl is attracting a more diverse audience, we still end up with the largest share of below-average ABX Index scores in the past ten years.

Exhibit 8 shows that Super-Bowl TV audiences are skewing to younger ages. The chart below is provided by Statista.

Exhibit 8: Likelihood of Watching the Super Bowl

(US Sports Poll, February 2024)

How Prospective Super Bowl Advertisers Can Hit it Big in 2025 and Beyond

Prospective Super Bowl advertisers can overcome these problems and achieve solid business results by adopting the following tips:

1 Carrie Gill, VP, Group Media Director, MMGY, “The impact of inflation on media buying in 2023,” 6/14/2023.

About Bottom-Line Analytics

Michael Wolfe, CEO

Bottom-Line Analytics has broad experience in marketing analytics covering marketing ROI, modeling, social media analytics, pricing, and brand strategy. Michael Wolfe leads the team as CEO with more than 30 years of direct experience in marketing analytics both on the client and consulting side. Michael has worked for Coca-Cola, Kraft Foods, Kellogg’s, and Fisher-Price. He and Bottom-Line Analytics have consulted with such blue-chip firms as AT&T, McDonald’s, Coca-Cola, Hyatt Corp., L’Oreal, FedEx and Starbucks. Michael has analyzed and written Super Bowl Advertising Effectiveness Reports for seven years.

Contact Michael at mjw@bottomlineanalytics.com at 770-485-0270

About ABX:

Advertising Benchmark Index, (ABX), is a leading ad effectiveness and consumer insights company with the largest global syndicated measurement solution, which evaluates ad creative effectiveness across all media types, competitors, countries, social sensitivities, demographic groups and more. The unique ABX Measurement Methodology ensures every ad across 14 KPIs and multitudes of variables are measured in the same way for accurate forecasts and correlations to revenues.

Press Inquiries:

Angela Jeffrey

VP Brand Management

ABX Advertising Benchmark Index

214-926-9794