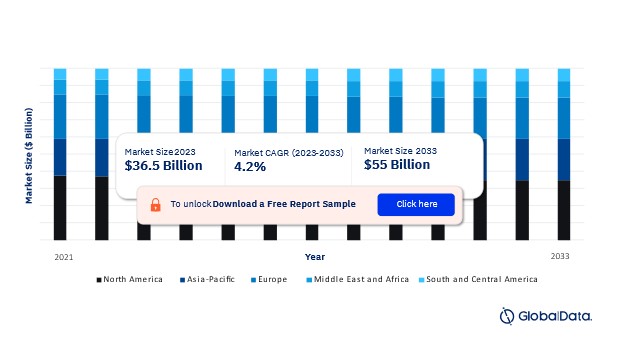

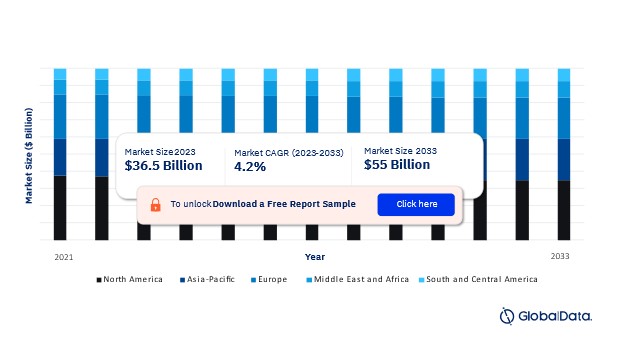

The global diagnostic imaging (DI) market is expected to reach USD 55.2 billion in 2033, according to a new report by GlobalData Plc. The market will be primarily driven by the increasing prevalence of chronic diseases, technological advancements, and the growing aging population.

Diagnostic Imaging (DI) Market by Region, 2021 – 2033 ($M)

Diagnostic Imaging (DI) Market Outlook Report is Available with GlobalData Now! Read our Free Sample Report

Diagnostic Imaging Devices Market FAQs

- What was the global DI market size in 2023?

The global DI market size will be valued at $36.5 billion in 2023.

- What is the DI market growth rate?

The global DI market is expected to grow at a CAGR of 4.2% over the forecast period (2023-2033).

- What is the key DI market driver?

Advancements in imaging technology is a prominent driver propelling growth and transformation of the diagnostic imaging market. Rapid developments in medical imaging techniques, modalities, and equipment are revolutionizing healthcare by enhancing diagnostic accuracy, enabling early disease detection, and facilitating more personalized treatment strategies.

- What are the key DI market segments?

- Product segment – Angio suites, bone densitometers, c-arms, computed tomography (CT) systems, CT systems, contrast media injectors, mammography equipment, MRI systems, nuclear imaging equipment, ultrasound systems, x-ray systems, contrast agents, and nuclear imaging agents

- Regional segment – North America, Europe, Asia-Pacific, South & Central America, and Middle East & Africa

- Which are the leading DI companies globally?

The leading DI companies are Bayer AG, Canon Inc, Cardinal Health Inc, Fujifilm Holdings Corp, GE Healthcare, Hologic Inc, Koninklijke Philips NV, Neusoft Corp, Shimadzu Corp, and Siemens AG.

Want to Get Answers to More Queries? Download a Free Sample Report

Diagnostic Imaging Devices Market Dynamics

Diagnostic imaging devices are used for visualizing the structural and functional patterns of organs or tissues. Angio suites, bone densitometers, c-arms, computed tomography systems, contrast media injectors, mammography equipment, MRI systems, nuclear imaging equipment, nuclear imaging agents, ultrasound systems, contrast agents, and x-ray systems are covered under this market. Diagnostic imaging is a critical tool in healthcare as it enables the early detection of diseases and medical conditions, often well before any symptoms manifest. This early identification is pivotal in improving treatment outcomes and elevating the likelihood of a complete recovery.

Imaging methods offer intricate and precise insights into the body’s internal structures and functions. This precision plays a pivotal role in the medical field, enabling healthcare professionals to make highly accurate diagnoses, thus significantly reducing the risks associated with misdiagnoses and unnecessary treatments. Moreover, diagnostic imaging has a profound impact on the planning of medical interventions. It provides essential information about the location, size, and nature of a medical condition, which is indispensable for specialists such as surgeons and oncologists. These specialists can design and implement highly effective and targeted treatment strategies, resulting in more successful patient outcomes. In essence, diagnostic imaging is an indispensable pillar of modern medicine, revolutionizing disease management and the delivery of healthcare services.

Learn about the Diagnostic Imaging (DI) Market Dynamics by Viewing Report Sample Right Here!

Diagnostic Imaging (DI) Market Report Highlights

- The global DI market is projected to witness a CAGR of 4.2% from 2023 to 2033. Diagnostic imaging allows healthcare providers to monitor disease progression or the effectiveness of treatment over time. Many minimally invasive procedures rely on diagnostic imaging to guide surgical instruments to the precise location within the body. This reduces the need for open surgeries, leading to faster recovery and fewer complications.

- The ultrasound systems segment is leading the market with more than 17% revenue share in 2023. The need for ultrasound systems in the diagnostic imaging market has been consistently increasing due to several key factors and trends. Ultrasound, also known as sonography, is a non-invasive imaging technique that uses high-frequency sound waves to create real-time images of the body’s internal structures.

- The US is the leading market in terms of revenue generation. The US has one of the most advanced and extensive diagnostic imaging markets in the world. It encompasses a wide range of imaging modalities, technologies, and services used for medical diagnosis and monitoring. The US diagnostic imaging market is characterized by innovation, research, and a commitment to providing state-of-the-art healthcare services.

- The Middle East and Africa market is anticipated to grow at a CAGR of over 6% over the forecast period. This growth projection highlights the increased healthcare investments, a growing population, and rising awareness of the importance of early disease detection and management. While the market in MEA may not be as mature as in some developed regions, it is steadily expanding and adopting advanced imaging technologies.

- Major companies in the diagnostic imaging market employ several key strategies to maintain their competitive edge and expand their market presence. These strategies are often a combination of innovation, partnerships, market diversification, and customer-focused approaches. Their commitment to innovation, customer satisfaction, and global expansion positions them as leaders in this critical healthcare sector. The leading DI companies are Siemens AG, Koninklijke Philips NV, Fujifilm Holdings Corp, GE Healthcare, and Canon Inc.

Unlock additional market dynamics impacting the Diagnostic Imaging (DI) market growth by Requesting a Sample PDF.

Diagnostic Imaging (DI) Market Scope

GlobalData Plc has segmented the DI market report by product and region:

Global Diagnostic Imaging (DI) Product Outlook (Revenue, $ Million 2021-2033)

- Angio Suites

- Single Plane Angio Suites

- Biplane Angio Suites

- Bone Densitometers

- Dual Energy X-ray Absorptiometry (DEXA)

- Quantitative Ultrasound (QUS)

- C-Arms

- Mobile C-Arms

- Fixed C-Arms

- Computed Tomography (CT) Systems

- 256-320 slice CT Systems

- 128-slice CT Systems

- 64-slice CT Systems

- 20-40 slice CT Systems

- 16-slice and below CT Systems

- Contrast Media Injectors

- Computed Tomography (CT) Injectors

- Magnetic Resonance Imaging (MRI) Injectors

- Angiographic Injectors

- Mammography Equipment

- 2D Digital Mammography Equipment

- Breast Tomosynthesis

- Retrofit Breast Tomosynthesis

- MRI Systems

- 3T MRI Systems

- 5T MRI Systems

- 2T-1.2T MRI Systems

- Nuclear Imaging Equipment

- Positron Emission Tomography (PET) Systems

- Positron Emission Tomography/Computed Tomography (PET/CT) Systems

- Positron Emission Tomography/Magnetic Resonance Imaging (PET/MRI) Systems

- Single Photon Emission Computed Tomography (SPECT) Systems

- Single Photon Emission Computed Tomography/Computed Tomography (SPECT /CT) Systems

- Ultrasound Systems

- 2D Ultrasound Systems

- 3D Ultrasound Systems

- Real-Time 3D/4D Ultrasound Systems

- Handheld Ultrasound (HHU) Systems

- X-ray Systems

- Computed Radiography (CR) X-ray Systems

- Direct Digital Radiography (DDR) X-ray Systems

- Contrast Agents

- Computed Tomography (CT) Contrast Agents

- Magnetic Resonance Imaging (MRI) Contrast Agents

- Ultrasound Contrast Agents (Microbubbles)

- Nuclear Imaging Agents

- PET Imaging Agents

- SPECT Imaging Agents

Global Diagnostic Imaging (DI) Regional Outlook (Revenue, $ Million, 2021-2033)

-

- France

- Germany

- Italy

- Spain

- Netherlands

- Switzerland

- United Kingdom

- Rest of Europe

-

- China

- India

- Japan

- Australia

- Rest of Asia-Pacific

-

- United Arab Emirates

- Saudi Arabia

- South Africa

- Rest of Middle East & Africa

Got any Specific Queries regarding Each Segment?

Enquire before Buying the Full Report

Related Reports

- Nuclear Imaging Equipment Market Size (Value, Volume, ASP) By Segments, Share, Trend And SWOT Analysis, Regulatory And Reimbursement Landscape, Procedures, And Forecast To 2033 – Click here

- X-Ray Systems Market Size (Value, Volume, ASP) By Segments, Share, Trend And SWOT Analysis, Regulatory And Reimbursement Landscape, Procedures, And Forecast To 2033 – Click here

- Computed Tomography Market Size (Value, Volume, ASP) By Segments, Share, Trend And SWOT Analysis, Regulatory And Reimbursement Landscape, Procedures, And Forecast To 2033 – Click here

- Magnetic Resonance Imaging (MRI) Systems Market Size (Value, Volume, ASP) By Segments, Share, Trend And SWOT Analysis, Regulatory And Reimbursement Landscape, Procedures, And Forecast To 2033 – Click here.

- Nuclear Imaging Agents Market Size (Value, Volume, ASP) By Segments, Share, Trend And SWOT Analysis, Regulatory And Reimbursement Landscape, Procedures, And Forecast To 2033– Click here.

- Angio Suites Market Size (Value, Volume, ASP) By Segments, Share, Trend And SWOT Analysis, Regulatory And Reimbursement Landscape, Procedures, And Forecast To 2033. – Click here.

About us

GlobalData is a leading provider of data, analytics, and insights on the world’s largest industries. In an increasingly fast-moving, complex, and uncertain world, it has never been harder for organizations and decision-makers to predict and navigate the future. GlobalData’s mission is to help our clients to decode the future and profit from faster, more informed decisions. As a leading information services company, thousands of clients rely on us for trusted, timely, and actionable intelligence. Our solutions are designed to provide a daily edge to professionals within corporations, financial institutions, professional services, and government agencies.