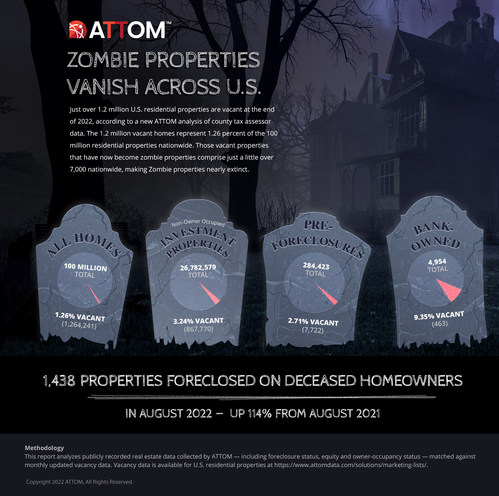

ATTOM, a leading curator of real estate data nationwide for land and property data, today released its fourth-quarter 2022 Vacant Property and Zombie Foreclosure Report showing that 1.3 million (1,264,241) residential properties in the United States sit vacant. That figure represents 1.26 percent, or one in 79 homes, across the nation.

The report analyzes publicly recorded real estate data collected by ATTOM — including foreclosure status, equity and owner-occupancy status — matched against monthly updated vacancy data. (See full methodology below). Vacancy data is available for U.S. residential properties at https://www.attomdata.com/solutions/marketing-lists/.

The report also reveals that 284,423 residential properties in the U.S. are in the process of foreclosure in the fourth quarter of this year, up 5.2 percent from the third quarter of 2022 and up 27.4 percent from the fourth quarter of 2021. A growing number of homeowners have faced possible foreclosure since a nationwide moratorium on lenders pursuing delinquent homeowners, imposed after the Coronavirus pandemic hit in 2020, was lifted at the end of July 2021.

Among those pre-foreclosure properties, 7,722 are zombie foreclosures (pre-foreclosure properties abandoned by owners) in the fourth quarter of 2022, up 0.2 percent from the prior quarter and 3.9 percent from a year ago. The count of zombie properties has grown in each of the last three quarters.

Click here for special Zombie Housing Market Infographic

“The government’s foreclosure moratorium dramatically reduced the number of properties in foreclosure,” said Rick Sharga, executive vice president of market intelligence at ATTOM. “Vacant and abandoned properties were among the few homes that could still be foreclosed on during the moratorium, so the number of zombie properties shrank as well. Now that the foreclosure ban has been lifted, we’re likely to see a gradual return to pre-pandemic levels.”

Despite the increase, the number of zombie-foreclosures remains historically low, representing just a tiny segment of the nation’s total stock of 100.1 million residential properties. Just one of every 12,963 homes in the fourth quarter of 2022 is vacant and in foreclosure, meaning that most neighborhoods still have no such properties. That ratio is almost exactly the same as in the third quarter of this year, although up 2.5 percent from one in 13,292 in the fourth quarter of 2021.

The portion of pre-foreclosure properties that have been abandoned into zombie status, meanwhile, continues to decline, from 3.3 percent a year ago to 2.8 percent in the third quarter of 2022 and 2.7 percent in the fourth quarter of this year.

The latest trends – zombie foreclosure numbers up slightly but remaining tiny – again reflect one of many high points from a housing market that has seen 11 years of nearly uninterrupted gains. Median home values nationwide have more than doubled since 2012, home-seller profits have shot up over 50 percent and the vast majority of homeowners have equity built up in their homes. Those forces provide enormous incentive for owners behind on their mortgages to do everything they can to avoid abandoning their properties even as foreclosure activity increases.

Home values dipped over the Summer of this year amid rising interest rates, a declining stock market and soaring inflation that have cut into what buyers can afford. But that has yet to significantly boost the presence of vacant properties in foreclosure.

Zombie foreclosures inch up again but remain miniscule portion of overall market

A total of 7,722 residential properties facing possible foreclosure have been vacated by their owners nationwide in the fourth quarter of 2022, up slightly from 7,707 in the third quarter of 2022 and from 7,432 in the fourth quarter of 2021.

While zombie foreclosures continue to be few and far between in most neighborhoods around the U.S., the biggest increases from the third quarter of 2022 to the fourth quarter of 2022 in states with at least 50 zombie properties are in Kansas (zombie properties up 32 percent, from 44 to 58), Nevada (up 25 percent, from 81 to 101), Connecticut (up 15 percent, from 65 to 75), Georgia (up 15 percent, from 72 to 83) and Indiana (up 13 percent, from 239 to 270).

The biggest quarterly decreases among states with at least 50 zombie foreclosures are in Michigan (zombie properties down 23 percent, from 99 to 76), New Jersey (down 12 percent, from 240 to 211), North Carolina (down 10 percent, from 144 to 130), Ohio (down 9 percent, from 925 to 841) and Maine (down 7 percent, from 72 to 67).

New York has the highest overall number of zombie homes to all residential properties (1,995 pre-foreclosure vacant properties), followed by Florida (1,030), Ohio (841), Illinois (780) and Pennsylvania (368).

“Low vacancy rates are also a major factor in there being few zombie homes,” Sharga added. “And with demand from both traditional homebuyers and investors still relatively strong, and the inventory of homes for sale still very low, vacancy rates for residential homes is about as low as it’s ever been,”

Overall vacancy rates dip for third straight quarter

The vacancy rate for all residential properties in the U.S. has dropped for three quarters in a row. It now stands at 1.26 percent (one in 79 properties), down from 1.28 percent in the third quarter of 2022 (one in 78) and from 1.33 percent in the fourth quarter of last year (one in 75).

States with the biggest annual drops are Tennessee (down from 2.3 percent of all homes in the fourth quarter of 2021 to 1.25 percent in the fourth quarter of this year), Minnesota (down from 1.18 percent to 0.81 percent), Wisconsin (down from 1.02 percent to 0.69 percent), Georgia (down from 1.79 percent to 1.5 percent) and Oregon (down from 1.14 percent to 0.94 percent).

Other high-level findings from the fourth quarter of 2022:

Report Methodology

ATTOM analyzed county tax assessor data for about 100 million residential properties for vacancy, broken down by foreclosure status and owner-occupancy status. Only metropolitan statistical areas with at least 100,000 residential properties and counties with at least 50,000 residential properties were included in the analysis. Vacancy data is available at https://www.attomdata.com/solutions/marketing-lists/.

About ATTOM

ATTOM provides premium property data to power products that improve transparency, innovation, efficiency and disruption in a data-driven economy. ATTOM multi-sources property tax, deed, mortgage, foreclosure, environmental risk, natural hazard, and neighborhood data for more than 155 million U.S. residential and commercial properties covering 99 percent of the nation’s population. A rigorous data management process involving more than 20 steps validates, standardizes, and enhances the real estate data collected by ATTOM, assigning each property record with a persistent, unique ID — the ATTOM ID. The 30TB ATTOM Data Warehouse fuels innovation in many industries including mortgage, real estate, insurance, marketing, government and more through flexible data delivery solutions that include bulk file licenses, property data APIs, real estate market trends, property reports and more. Also, introducing our newest innovative solution, that offers immediate access and streamlines data management – ATTOM Cloud.

Media Contact:

Christine Stricker

949.748.8428

christine.stricker@attomdata.com

Data and Report Licensing:

datareports@attomdata.com