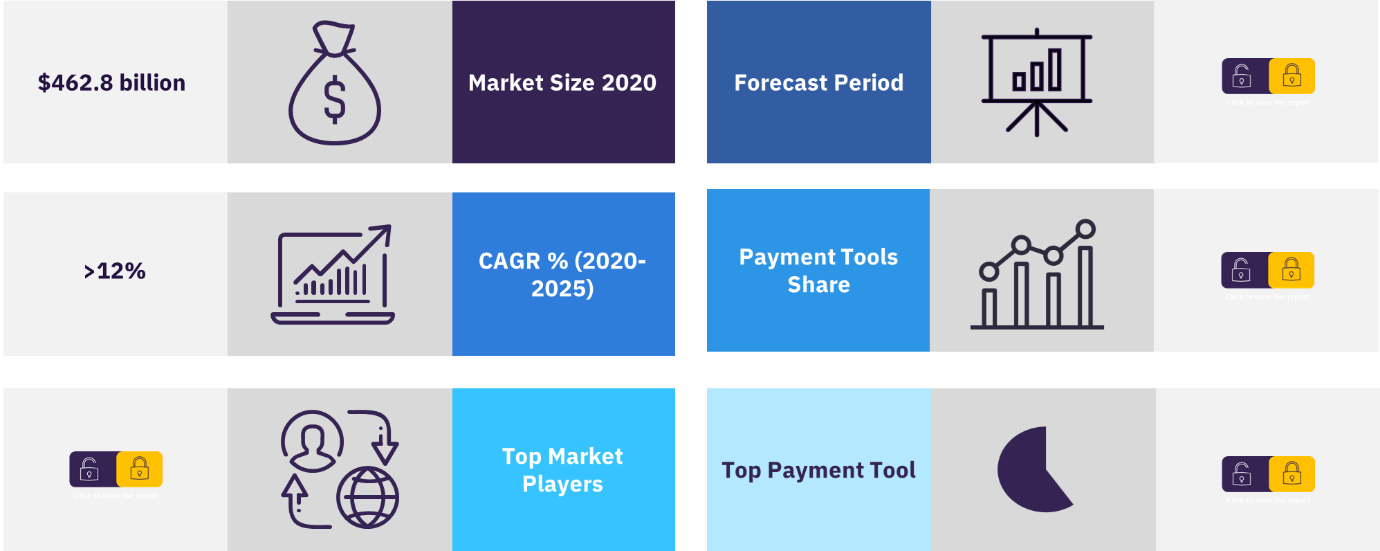

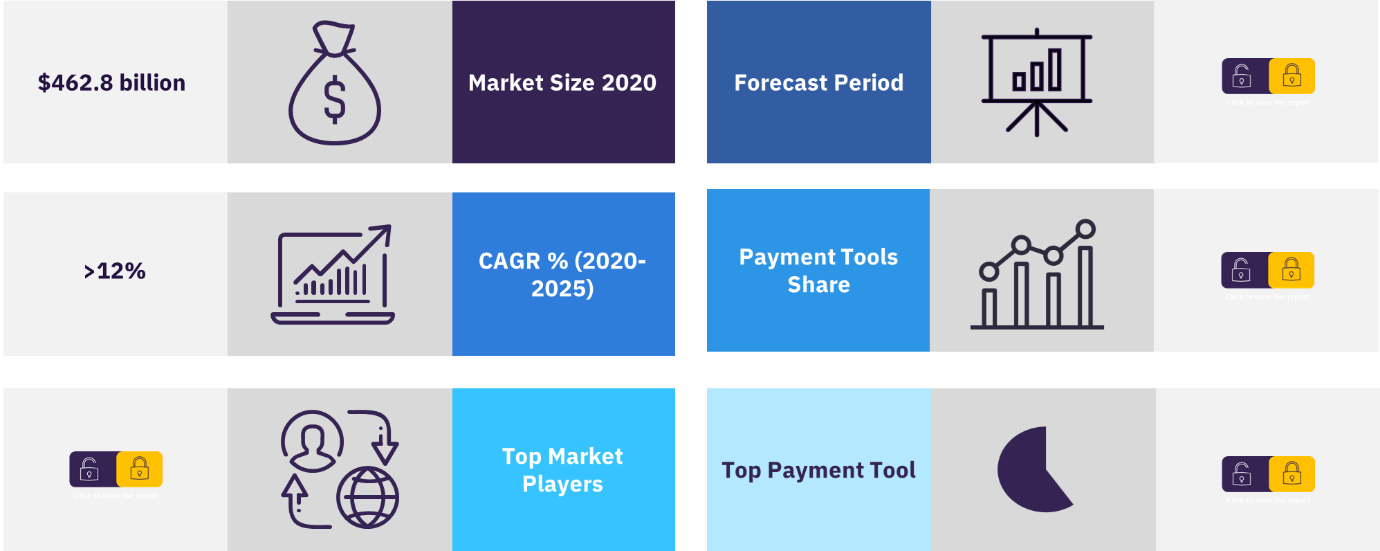

The latest publication by GlobalData Plc titled Online Payments in Apparel – Thematic Research evaluates the pandemic boosting online payments and apparel retailers offering frictionless payment methods as the prominent driving factors. Furthermore, with the rising adoption of mobile commerce post the pandemic, the demand for online shopping and sales through online platforms will surge considerably in the apparel and retail sector.

For more insights on the key market dynamics, Read FREE Sample PDF

Online Payments Industry Trends

This online payments in apparel thematic research has identified key trends impacting the market over the next one to two years. The trends are mainly classified as –

- Technology trends

- Biometrics

- Buy Now Pay Later

- Central Bank Digital Currencies (CBDCs)

- Cryptocurrencies

- Non-fungible tokens

- Industry trends

- Cashier-less stores

- Contactless payments

- Customer loyalty

- Secure payments

- Social commerce

- Macroeconomic trends

- COVID-19

- Cross-border payments

- Electronic payments push

- Regulations on Blockchain and BNPL

- Geopolitics and China

Download the Sample PDF for a detailed analysis of prominent trends covered

Online Payments Market Players

The online payments industry is fragmented owing to various participants involved in payment transactions. The degree of fragmentation is further expected to intensify during the forecast period due to the presence of a large number of payment options available to consumers. Furthermore, the already established companies are investing heavily in new solutions through M&As. This is expected to aid the players in maintaining their dominance in terms of online payments market share and in competing with emerging disruptors and start-ups.

Some of the top online payments market players covered in the report are:

- Alipay: As of August 2020, Alipay had amassed one billion users, accounting for 55.4% of the market share in the mobile payments market; the Alibaba platform is the most popular shopping website and around 70% of transactions use Alipay. International demand for Alipay’s online payments has allowed the company to expand to more than 250 overseas financial institutions and payment solution providers. For instance, in 2018, clothing retailer Guess started accepting payments via Alipay at stores in main tourist destinations such as Los Angeles, Las Vegas, and New York.

- Amazon: Launched in 2007, Amazon Pay is the payments arm of US e-commerce leader Amazon. In April 2020, Amazon Pay introduced the Amazon Pay Later instant credit service in partnership with online credit solutions provider Capital Float and Karur Vysya Bank (KVB) in India. In August 2021, the company announced a partnership with BNPL company Affirm to offer customers deferred payments. In April 2021, Amazon Pay launched the Amazon Pay for Business app in India, enabling SMEs to accept digital payments via Amazon Pay QR codes. Customers can pay by scanning QR codes through any UPI-based payment app.

- Google Pay: Google launched Google Pay, an online payment and digital wallet service, in its current format in 2018 by combining Google Wallet and Android Pay. In October 2021, Google Pay partnered with the digital asset marketplace Bakkt to enable payments via cryptocurrencies. Bakkt offers its users a debit card that is then added to the Google Pay app; this can be accessed to convert cryptocurrencies to fiat money.

- Paytm: Paytm’s focus remains on person-to-merchant payments, which has made it a prominent force in retail payments as it serves 450 million users (as of August 2021) and has onboarded 21.2 million merchants (as of March 2021). In March 2021, the company launched the ‘Paytm Smart POS app, allowing merchants to accept payments from contactless cards using NFC-enabled Android mobile devices, without the need for an additional card reader. It is also taking steps into the BNPL market with the launch of ‘Paytm Postpaid’.

- Visa: Visa is a multinational financial services corporation that serves individual and commercial clients, financial institutions, government entities, and merchants. Visa is expanding its online payment capabilities by developing merchant solutions that simplify consumers’ online experience and make transactions more secure. Through a partnership with Mastercard, Discover, and American Express it created the Click to Pay online checkout solution, which saves consumers’ card data to allow quicker checkout.

For more latest strategic moves by each vendor above, Download Sample at: https://www.globaldata.com/store/talk-to-us/?report=3161492

Other prominent online payments market participants include:

- ACI Worldwide

- Adyen

- Affirm

- Afterpay

- American Express

- Apple

- Danske

- Klarna

- Kroger Pay

- Lola Moda

- Marks & Spencer

- Mercado Pago

- Revolut

- Samsung

- Square

- Tenpay

- Walmart Pay

Want to get additional product offerings from each contributing vendor? Request a Sample Report Now!

Related Reports:

Online Payments – Thematic Research

Online Payments in Retail – Thematic Research

About GlobalData

GlobalData is a leading provider of data, analytics, and insights on the world’s largest industries. As a leading information services company, thousands of clients rely on GlobalData for trusted, timely, and actionable intelligence. Our mission is to help our clientele ranging from professionals within corporations, financial institutions, professional services, and government agencies to decode the future and profit from faster, more informed decisions. Continuously enriching 50+ terabytes of unique data and leveraging the collective expertise of over 2,000 in-house industry analysts, data scientists, and journalists, as well as a global community of industry professionals, we aim to provide decision-makers with timely, actionable insights.

Media Contacts:

Mark Jephcott

Head of PR EMEA

mark.jephcott@globaldata.com

cc: pr@globaldata.com

+44 (0)207 936 6400