A new, trailblazing report refutes the current misconception that rental apartments priced for the middle-income workforce—such as teachers, nurses, and first responders—have a lower return on investment than apartments with higher rent levels, paving the way for Moderate-Income Rental Housing to be a competitive ESG investment.

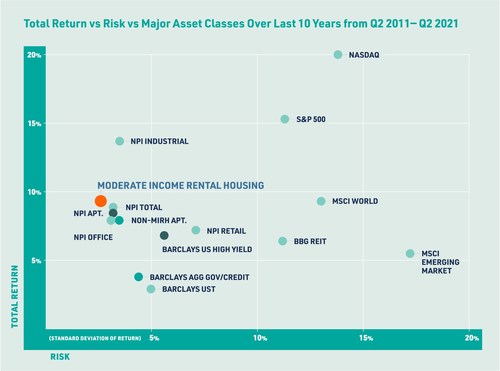

The report, sponsored by Affordable Central Texas and the Wells Fargo Foundation, defines a new asset class as Moderate-Income Rental Housing (MIRH), or large, multifamily rental properties occupied by tenants earning between 60 percent and 120 percent of the Median Family Income (MFI) with at least half the residents earning less than 80% of MFI. Analyzing data since 2011, the report demonstrates MIRH assets outperformed rental properties with higher rents, averaged an unleveraged return of 9.4 percent, and had the lowest risk, 2.6 percent spread when compared to other real estate asset classes.

“Demand for affordable rental housing for moderate-income households is surging as homeownership becomes unobtainable for many. At the same time, interest in Environmental, Social, and Governance investments is growing rapidly,” said David Steinwedell, President and CEO of Affordable Central Texas. “We can’t afford to lose the people who power our communities, and we have a market solution to a market problem. MIRH delivers consistent, predictable returns and makes a real difference in the lives of our neighbors.”

In 2021, Environmental, Social, and Governance (ESG) funds accounted for 10 percent of worldwide fund assets. According to a new report by Bloomberg Intelligence, global ESG assets may surpass $41 trillion by 2022 and $50 trillion by 2025. ESG’s in the U.S. are taking the lead with more than 40 percent growth in the past two years and are expected to exceed $20 trillion in 2022.

The report drew on data from the National Council of Real Estate Investment Fiduciaries Property Index and analyzed eight metropolitan areas—Atlanta, Austin, Dallas, Denver, Houston, Phoenix, Seattle, and Washington, DC, from Q2 2011 to Q2 2021. The nation’s three largest metros, New York, Los Angeles, and Chicago, lacked enough MIRH assets to allow for analysis due to their well documented affordability challenges.

The research was prepared by Mark G. Roberts, Director of Research at the Folsom Institute for Real Estate at Southern Methodist University Cox School of Business, and Jake Wegmann, Associate Professor at the Community & Regional Planning Program at the University of Texas at Austin School of Architecture.

The full report and further information about MIRH’s performance as a new asset class can be found at: https://austinhousingconservancy.com/moderate-income-rental-housing-report/.

Affordable Central Texas (ACT), in conjunction with Austin Housing Conservancy Fund, works to ensure Austin’s workforce can afford to live in greater Austin by building a scalable social impact fund aimed at preserving well-located multi-family apartment properties for long-term affordability. ACT is a 501(c)(3) charitable nonprofit formed in 2016 by local Austin real estate and affordable housing veterans to manage the activities and investments of the Fund, providing stable and affordable workforce housing in and around Austin. www.austinhousingconservancy.com