Elevated home prices and rising interest rates are feeding into housing affordability woes for potential buyers, especially those with lower credit scores. A new Zillow analysis shows that, nationally, buyers with “fair” credit could be paying up to $288 more on their monthly mortgage payment than those with “excellent” credit.

Today’s home shoppers can expect to pay around 62% more per month to buy a typically priced U.S. home than they would have a year ago. Zillow examined credit scores against current mortgage rates and found that such monthly cost increases are exacerbated for millions of Americans with low credit scores or less than perfect credit histories.

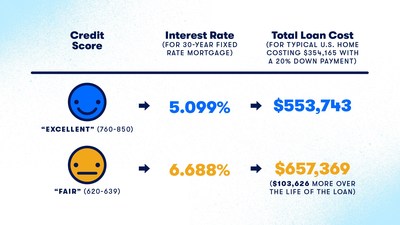

A borrower with an “excellent” credit score — between 760 and 850 — can qualify for a 30-year fixed-rate mortgage with a 5.099% interest rate1. For the same loan, a similar borrower with a “fair” credit score — between 620 and 639 — qualifies for a 6.688% rate1. This equates to a $288 difference in monthly mortgage payments and nearly $103,626 in interest over the life of a 30-year fixed loan, based on the current price of a typical U.S. home ($354,165)2.

“When you are thinking about buying a home, the best first step you can take is to fully understand your financial picture, what you can afford and your outstanding debts or obligations,” said Libby Cooper, Zillow Home Loans vice president. “If you find you have low credit, take realistic steps to improve your credit score by doing things like disputing possible report errors and paying down as much debt as possible. This could increase the amount of home loan you qualify for.”

The chart below illustrates how a buyer’s credit profile plays an important role in how much a home ultimately costs. Buyers who make raising their credit score part of their initial steps in the home-buying process typically have more buying power and lower monthly payments.

The cost of buying a typically priced U.S. home based on credit scores3

|

FICO® Score |

Estimated Annual |

Monthly Payment |

Total Loan Cost

|

|

760–850 |

5.099 % |

$1,538 |

$553,743 |

|

700–759 |

5.321 % |

$1,557

|

$567,739 |

|

680–699 |

5.498 % |

$1,608 |

$579,014 |

|

660–679 |

5.712 % |

$1,647 |

$592,782 |

|

640–659 |

6.142 % |

$1,725 |

$620,882 |

|

620–639 |

6.688 % |

$1,826 |

$657,369 |

There is a direct correlation between credit security — having a strong credit history and structural access to credit offerings — and higher homeownership rates. The homeownership rate is lower in counties that are more “credit insecure,” meaning they are home to high numbers of residents with poor or no credit history. That cuts off millions — particularly Black and Latinx residents — from the wealth-building advantages of homeownership. Additionally, Black applicants are denied a mortgage at a rate 84% higher than white applicants, and credit history is the most common reason cited for those denials. Limited traditional financial services in Black and other communities of color are a significant factor in the lack of credit history and the inability to build a high credit score.

Fannie Mae and Freddie Mac recently adopted policies that include timely rent payments in their automated underwriting systems. Lenders and brokers can submit bank account data (with borrower permission) to identify 12 months of prompt rent payments to help potential borrowers qualify for a mortgage.

“While inclusion of timely rent payments doesn’t change a borrower’s credit score, it can have a positive impact on how lenders view a borrower’s credit worthiness. This move shows how effective policy changes can help consumers build a strong financial foundation that unlocks homeownership,” said Cooper.