Age is one of the most critical factors in determining what you’ll pay for permanent and term life insurance policies. The older you are, the more you tend to pay in premiums. But keep in mind that several things could change your premiums. This article will look at permanent and term life insurance rates by age and explore factors that could impact your premiums.

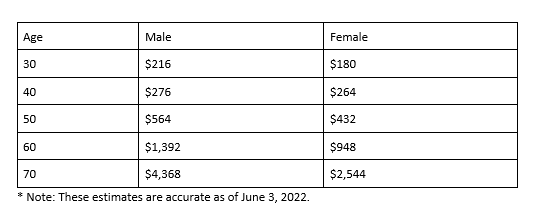

According to Forbes, here are the average annual costs for a 10-year, $500,000 term life insurance policy across various age groups, assuming a healthy, non-smoking policyholder:

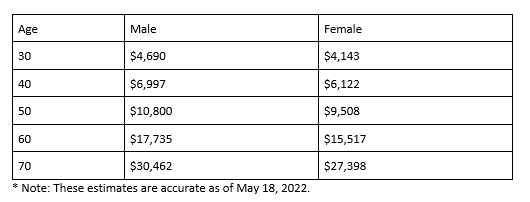

Here are some estimates from NerdWallet for the annual cost of a whole life insurance policy, the most common type of permanent life insurance, based on healthy, non-smoking applicants seeking a $500,000 death benefit:

Age is important, but it’s only one of many factors that can influence your life insurance rates. Here are a few others to consider:

Your coverage amount is one of the most direct factors impacting your permanent and term life insurance rates. The higher your death benefit, the larger your monthly premium.

Term length also impacts premiums for term life insurance. Longer term lengths will cost more in premium payments. This is also why permanent life insurance is more expensive than term life insurance — these policies last for your entire lifetime, no matter how long you live.

On average, males will pay more for life insurance coverage than females, assuming the same level of coverage and other factors held equal.

Policyholders in great health can lock in the best premiums. However, if you have a health condition, you may pay more. Similarly, smokers will pay more than non-smokers for the same amount of coverage.

Certain jobs are deemed high-risk, like airline pilots and power line workers. If you work in one of these roles, your life insurance coverage may cost more.

Some lifestyle choices can also cause you to pay higher premiums. High-risk hobbies and interests include paragliding, skydiving, and car racing.

As you can see, both permanent and term life insurance rates get far more expensive with age. Fortunately, you can lock in premiums if you get your policy early, potentially saving you money while ensuring you get coverage.

You can find further savings by improving your health and adjusting coverage amount or term length. Finally, shopping around for multiple quotes can help you find the best rates on the coverage you need.