The national marina brokerage firm managed the marina sale as a confidential offering transacted through the Simply Marinas Network of qualified marina buyers. The marina was sold to Suntex Marinas. Simply Marinas’ brokers represented both parties.

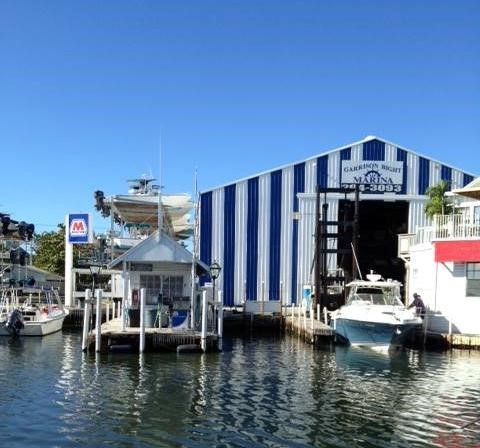

Garrison Bight Marina has a dry storage facility as well as wet slips. It offers a full-service department with one of the largest parts and marine hardware inventories in Key West. In addition, the facility houses a deep-water access fuel dock complete with ethanol-free gasoline, a ship’s store with an array of snacks and bait and tackle, charter services, and the best Thai food on the island at Thai Island Restaurant.

Simply Marinas represented the seller of Garrison Bight Marina on the sale of 6 marinas, including the recent sale of two of the largest marinas in Nashville, Tennessee, Four Corners Marina, and RV Park, and Cedar Creek Marina. Many of the company’s transactions were built upon the invaluable industry relationships that the Simply Marinas team has been building with clients as they have bought and sold marinas over the past two decades.

The Simply Marinas team is seeing tremendous interest in buying marinas. The company has handled 25 marinas transactions over the last 12 months. George Ash, Simply Marinas National Director said in an interview with Marina Dock Age Magazine “Marinas, in general, have enjoyed tremendous revenue increases across all profit centers (storage, service and repair, boat sales, boat rentals, food, and beverage, etc.). Investors from Wall Street and from traditional commercial real estate assets, such as multifamily, office, retail, and self-storage, started paying attention and have been focusing on marina acquisitions. Groups that own marinas nationally continued to consolidate and compete for prime marinas.”

Simply Marinas sees today’s marina financing market changing for the better with more financing resources available. And, today’s lower interest rates support a higher debt coverage ratio, a critical factor in lending. While the market has seen an abundance of cash buyers, banks have been increasingly more receptive to lending on marinas, and even in some cases, offering interest-only financing at low-interest rates. These factors, along with an attractive financing environment and new funds dedicated to marinas, created a compression of cap rates in the marina space. “Prior to 2021, we saw a cap-rate average ranging between 7.5% to 9%. In 2021, we sold marinas at 6 to 8%,” Ash said.

Michelle Ash, broker with Simply Marinas, was also quoted saying, “Limited marina inventory and high barriers to entry for developing new marinas, coupled with recent and continued growth in recreational boating, indicate that marina market activity should continue to grow. We see no signs of a slow-down in both buyer and seller interest and expect that Simply Marinas, and the marine industry in general, will have another great year in 2022.”

Simply Marinas’ brokers are looking to identify quality marinas for sale. They represent qualified clients who depend on their team to find the right marina assets. The Simply Marians family office participates, at times, as an equity partner or lender with their clients.

About Simply Marinas

Simply Marinas has been a leader in marina acquisitions and dispositions for more than 20 years and across more than 250 transactions. A family-owned and operated business, we are marina investors and lenders who offer our clients expertise from presale groundwork through valuation, due diligence, financing, and successful closings. Contact us at team@simplymarinas.com , or 305-390-0397 to find out how our network of over 13,000 marina investors, as well as our experience, can help you close the deal. For more information on the company track record, offerings and case studies, visit www.simplymarinas.com. Many of our offerings are confidential and are not on the website. Please register with our team to receive our offerings.