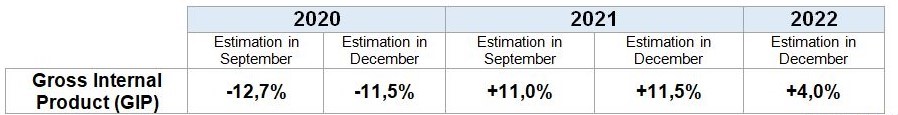

The next two years look very auspicious for the Peruvian economy. By December 2021, a recovery of 11.5% is estimated, while for 2022 a growth of 4% compared to the previous year is projected, according to the latest Inflation Report of the Central Reserve Bank of Peru (BCRP). In this, an upward adjustment of the projections estimated for those years is shown, after showing an estimated fall of 11.5% in 2020.

GIP Projection by 2022

Peru historically records the lowest country risk in the region, a performance that can be seen in the latest results recently achieved, where it registered 135 PBS last Friday, December 18; the lowest value achieved in recent months since February.

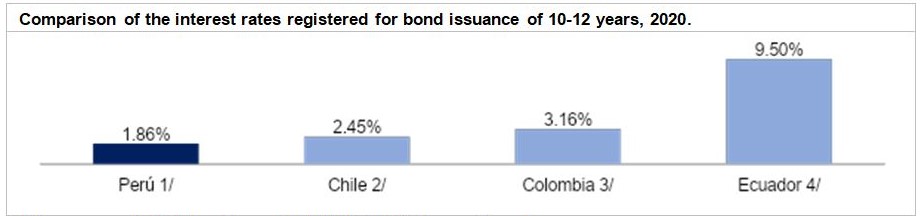

This low country risk contributed to the success of the last issuance of Peruvian bonds in the international market, obtaining the lowest interest rates historically achieved in comparison with other countries in the region.

In the following table we can see the comparison of the interest rates registered for the issuance of bonds in 2020 in economies of the region, where Peru is positioned as the lowest.

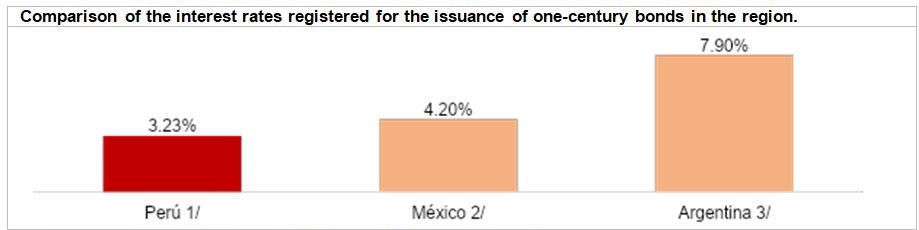

Likewise, with the 101-year bond issue carried out this past November 23, Peru becomes one of the few countries in the world with a century-long bond, including Mexico, Argentina, Belgium, Ireland, China, Denmark or Sweden. Having the lowest-interest rate achieved compared to those obtained by the other countries in the region that have issued one-century bonds.

Peru registered an inflation rate of 2.1% in 2019, considered one of the lowest in the region. This result is consistent with the inflation expectations that would be recorded in Peru for 2020 and 2021. Furthermore, according to the IDB’s Revela portal, Peru’s inflation expectations are the lowest in the region, which reduces uncertainty in an economy.

Comparatively, as already noted, Peru has one of the best performances in the region so far in 2020, which strengthens its position in Latin America and improves the perception of foreign investors.