Hunt Valley, MD–July 17, 2020 The business opportunities made possible by the next generation of broadcast technology—especially in datacasting and mobility—dwarf the broadcast business as we know it.

Hunt Valley, MD–July 17, 2020 The business opportunities made possible by the next generation of broadcast technology—especially in datacasting and mobility—dwarf the broadcast business as we know it.

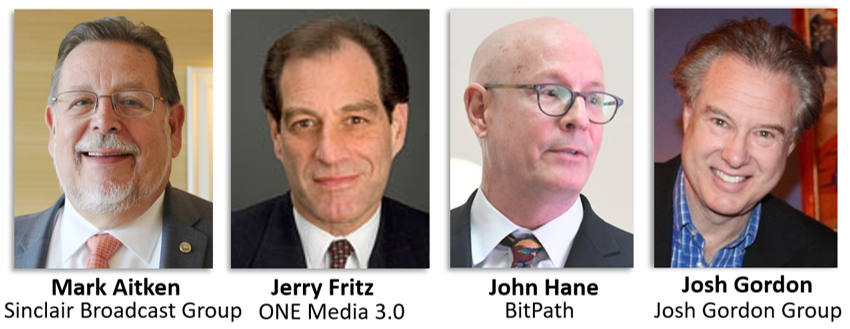

“You have to think about broadcasting in terms of the IP infrastructure of this country, not the same business we’ve been in for a long time,” said Mark Aitken, president of ONE Media 3.0, an organization coordinating the technical deployment of ATSC 3.0, a bit-transport technology unlike any other now in use. Aitken laid out a vision of the financial potential of integrating broadcasting into the nation’s IP infrastructure during the recent first webinar of a six-episode series on making money with ATSC 3.0. “We are building the equivalent of a broadcast telco.”

This broadcast telco vision encompasses a data commodities market over a CONUS network with unprecedented last-mile delivery capacity—alongside the traditional television business updated for a technologically sophisticated market. That’s where mobility comes in—content delivery must be mobile to remain viable.

“The first thing we have to consider if we want to win back younger viewers… we have to give them robust mobile access,” said TV industry veteran Josh Gordon, who unveiled market survey results indicating that among 2,067 respondents, nearly 70 percent of the 18-21 Gen Z respondents watch TV on their phones, compared to 24 percent of boomers aged 54 -72. The finding is reflected in a 2019 Interactive Ad Bureau/PwC report indicating a rapid ad revenue shift from desktop to mobile since 2012, when mobile raked in about 90 cents out of every $10 spent on both platforms.

“Today, seven out of every $10 is from mobile,” Gordon said. “Mobile is where the money is.”

Mobility also offers a point of data collection and management, much the same way a cable, satellite or OTT streaming box does. With ATSC 3.0 “Chips in Phones”, a broadcast TV mobile app acts as a set-top box on the go and can unlock the ability to target audience segments based on content preference, buying patterns and hyper-localized weather alerts and emergency information. (These concepts will be further fleshed out in subsequent webinars, including “NexGen News & Alerting,” on July 21 at 2 p.m. ET; and “NexGen Advertising,” Aug. 4 at 2 p.m. ET. Register here.)

“The business goal is to increase the asset value,” said ONE Media 3.0 Executive Vice President and webinar moderator Jerry Fritz. The asset is the 6 MHz of spectrum assigned to each TV license, which, in its current form, is vastly underperforming the competition. On a data-rate basis, Fritz said, diginets generate about one one-thousandth of a cent per gigabyte versus the $2 per GB telcos make in the same amount of spectrum. That’s where data broadcasting’s “one to many” can tip the scales.

The potential for data broadcasting is “huge,” said John Hane, a veteran broadcast attorney who now heads up broadcast data network accelerator BitPath. “We can do capacity leasing… highly secure file delivery… IoT, real-time broadcast data streaming; passive and active wireless offload,” and more. The key is nationwide coverage over a “core” network of shared bandwidth, made more robust as more stations contribute within each designated market area. Hane refers to this type of saturation as “depth.”

Single-frequency networks, or SFNs, would further contribute depth and enable the targeting capability mentioned earlier. According to Aitken: “Single frequency networks help coverage gaps and provide higher saturation of power, thus using SFNs in a distributed transmission system can [generate] two-and-a-half times the mobile data rate to twice the service area.”

Hane emphasized the need for this type of architecture. “We have to create critical mass. It’s a national marketplace, not a series of local marketplaces… No one’s going to rely on our platform if we don’t have coverage in the major markets.”

This nationwide, core bandwidth network is a non-lift revenue opportunity. Recall that ATSC 3.0 bumps the TV channel bit rate up from 19.4 to 25 Mbps, and carries an HDTV signal in 3 Mbps instead of 11. Even with the addition of a prime-time video and audio enhancements, local data services and a few diginets, licensees will have bandwidth to contribute to the core network proposed by BitPath. BitPath, in turn, would provision bandwidth for national clients seeking large-scale capability that cellular networks can’t provide because of their one-to-one transmission method.

ATSC 3.0 data broadcasting is one-to-many. E.g., Microsoft updating 30 million operating systems simultaneously would choke a cellular network. With Netflix already causing bottlenecks, telcos will need data broadcasting for things like IoT and vehicle telemetrics for example, especially with the fleet of autonomous vehicles expected to hit the road in 2022. (This will be explored Aug. 18 at 2 p.m. in the “Datacasting” episode, featuring, among others, Jeff Kaelin, vice president of product development for Avis Budget Group.)

In turn, broadcasters will have access to the return channel necessary to collect data. Aitken calls this “convergence.” That means unprecedented device portability for local broadcasters. It also opens door to dynamic ad insertion and all manner of third-party app development and platform access.

“When you have a converged platform,” Aitken said, “Local services become part of the smart TV ecosphere. Smart TV market revenue is now $40 billion, expected to be $67 billion by 2025.”

Incumbent upon this broadcast telco vision is the receiver. Several appeared at CES this year, however, Sinclair is now developing its own.

“Sinclair plans to introduce will be an unlocked device, so it will work across AT&T and other networks,” Aitken said. “We expect to have it in hand in August.”

The information from this article came from a webinar. Sign up for more webinars in this series