(Tampa and Naples, FL, July 15, 2020) Paul Fioravanti is Managing Partner of Qadent Management Services, LLC, a Florida based turnaround, restructuring, performance improvement firm, and is an expert on transforming businesses facing extreme difficulty. He advises, “Performance, responsiveness and results matter… it’s Darwinian; the businesses that will be standing on the other side of this pandemic are the ones most adaptable to change. Beyond embracing change, they must be proactive and communicative.”

He’s been involved in dozens of situations fixing companies across myriad industries for more than 20 years and a recent project was spearheading, as CEO, the global restructuring of a pharmaceutical manufacturer. The CDMO “contract development and manufacturing organization” was transformed, improving relations with its bank and vendors, prioritizing delivery and quality, improving (through contract renegotiation) all supply contracts with customers. By strategically realigning, the company shed loss making entities and improved EBITDA from FY 2018 to 2019 by increasing it from negative $45,000 to positive $30 million, saving more than 1,900 jobs.

He’s worked with small and large companies, owned by the “three P’s” as he calls it – privately held, publicly held, and private equity owned.

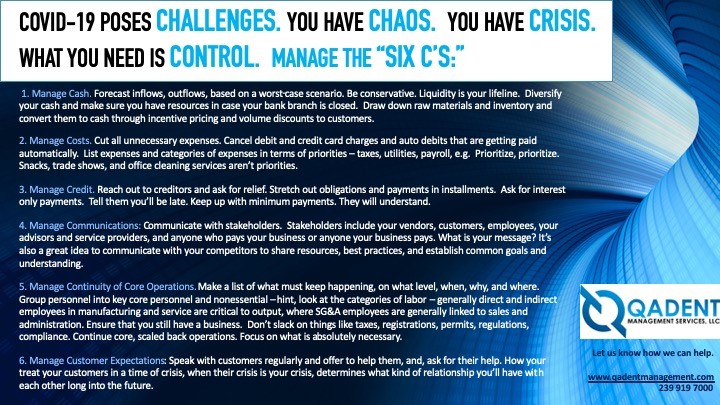

Fioravanti observes that “businesses have had one C, COVID-19, giving them another C, Challenge, in the form of two other C’s, Crisis and Chaos, and what they need to grasp the most critical C, Control.”

Fioravanti says, Calm (yet another C) comes from feeling in Control. He says businesses can feel back in control by “focusing on what Qadent calls the “Six C’s:”

1. Manage Cash. Forecast inflows, outflows, based on a worst-case scenario. Be conservative. Liquidity is your lifeline. Diversify your cash and make sure you have resources in case your bank branch is closed. Draw down raw materials and inventory and convert them to cash through incentive pricing and volume discounts to customers.

2. Manage Costs. Cut all unnecessary expenses. Cancel debit and credit card charges and auto debits that are getting paid automatically. List expenses and categories of expenses in terms of priorities – taxes, utilities, payroll, e.g. Prioritize, prioritize. Snacks, trade shows, and office cleaning services aren’t priorities. Neither are owner or principal perquisites.

3. Manage Credit. Reach out to creditors and ask for relief. Stretch out obligations and payments in installments. Ask for interest only payments. Tell them you’ll be late. Keep up with minimum payments. They will understand.

4. Manage Communications. Communicate with stakeholders. Stakeholders include your vendors, customers, employees, your advisors and service providers, and anyone who pays your business or anyone your business pays. What is your message? It’s also a great idea to communicate with your competitors to share resources, best practices, and establish common goals and understanding.

5. Manage Continuity of Core Operations. Make a list of what must keep happening, on what level, when, why, and where. Group personnel into key core personnel and nonessential – hint, look at the categories of labor – generally direct and indirect employees in manufacturing and service are critical to output, where SG&A employees are generally linked to sales and administration. Ensure that you still have a business. Don’t slack on things like taxes, registrations, permits, regulations, compliance. Continue core, scaled back operations. Focus on what is absolutely necessary.

6. Manage Customer Expectations. Speak with customers regularly and offer to help them, and, ask for their help. How you treat your customers in a time of crisis, when their crisis is your crisis, determines what kind of relationship you’ll have with each other long into the future.

Fioravanti adds, “Covid-19 is roaring back with a boomerang wave, and there are financial support resources out there now, but aside of those programs which may be exhausted, or may be a temporary fix, managers and business owners will be best served by strengthening the fundamentals of the business, managing stakeholder relationships.”

He adds, of course, in any business climate it’s always important to be constantly innovating through new and different ways to generate revenue, provide products and services, and most importantly, communicating proactively with “upstream” (vendors, lenders, e.g.) and “downstream” (customers, business partners) stakeholders.” We also believe paying attention to the “Six C’s” can ensure a stabilization and eventual rebound from the C-19 pandemic.”