Vital new ‘Covid-19 era’ report released by Engalco-Research on July 7, 2020:

Optical networking is already critically important for backhaul and fronthaul in all of the strongly expanding 5G architectures. Maximum transmission bit rates are typically in the 10 G through 400 G range and already 800 G has gained some ground. In response to these dynamic trends Engalco-Research has released a new report with recently researched data taking into account economic impacts due to the Covid-19 pandemic. Regarding optical networking equipment this report therefore effectively replaces the firm’s December 2019 release.

Terry Edwards, Research Director and Senior Executive at Engalco-Research, states: “The objectives leading up to this report were to identify the business opportunities for the optical networking equipment market within fronthaul and backhaul for 5G. An additional goal was to quantify these opportunities in both volume and value terms with nine-year forecasts covering each year over the range 2020-2029.”

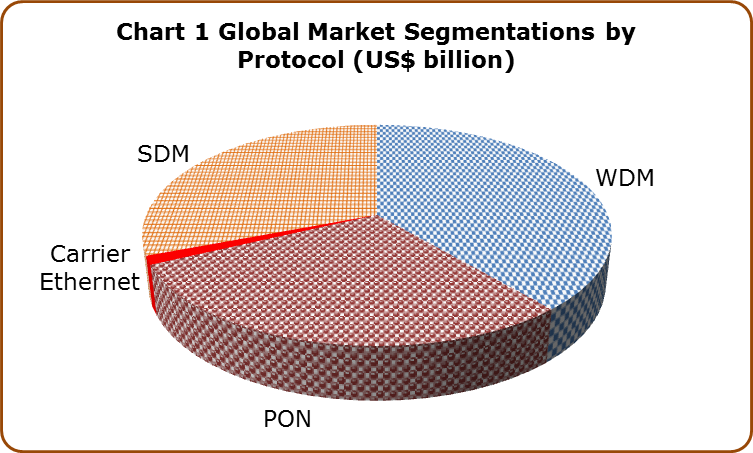

This report segments data applying to optical networking equipment according to the following protocols: WDM, PON, Carrier Ethernet and SDM. These terms are defined and described in the report. Overall total global markets will approach $7 billion by the close of 2020 and will grow at a CAGR exceeding 15% to reach $24 billion in 2029. Sales into the Asia-Pacific region always form the largest contribution – notably China but also India, Japan and South Korea. Global market segmentations for 2029 applying to the various protocols are indicated in Chart 1.

WDM always leads these markets although sales into PON and SDM applications also remain strong throughout the time scale of this report. New-generation PON (NG PON) increasingly dominates the PON space.

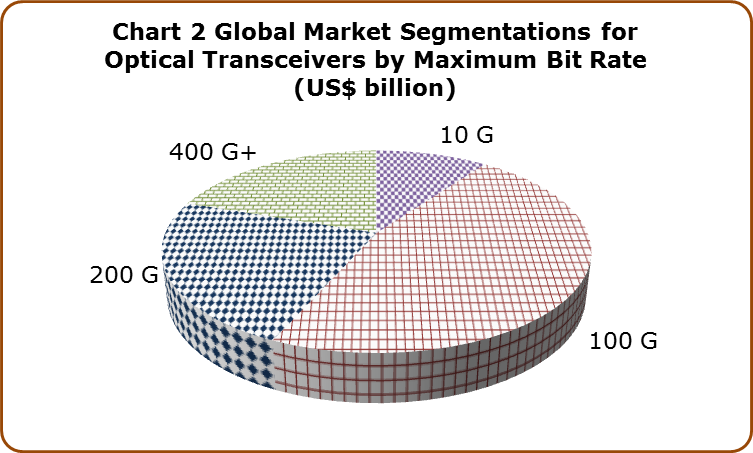

Optical transceivers are vitally important in this industrial sector and a major performance parameter associated with these products is the maximum bit rate they can handle. Broad market segmentations are shown in Chart 2 – complete details are provided in the report.

Throughout the forecast period transceivers with maximum capacities ranging from 100 G through 400 G will always remain important. 800 G (also some 1200 G) products are now entering this space.

On July 1, 2020 the US FCC Issued “Final Orders Declaring Huawei and ZTE National Security Threats”. This situation strongly impacts the dynamics of the entire industrial sector.

The core of this report comprises nine-year forecasts of all the protocols listed above and these are presented in terms of total addressable market (TAM) monetary values and shipments. The product/market strategies of leading actors across this space are analysed as well as appropriate strategies for optical networking and other firms to better penetrate the 5G fronthaul and backhaul market. Substantial details are provided concerning 18 communications services providers and 11 supply-side OEMs.

The methodology underlying this report comprised a combination of primary and secondary research.

To obtain more information about this report please visit: www.engalco-research.com and then order your copy by contacting the publisher directly via its Research Director and Senior Executive Terry Edwards.